Mike LeGassick: Savings & Investments

Meet & Greet the Minions at Camel Creek

28th June 2022

Keane & Parker Estate Agents

28th June 2022Mikes relationship with the finance profession goes hand in hand, except for the complex jargon that tags along with it. He believes there are ways to explain complicated matters that just instantly make sense and he proves this daily with his clients and did this with myself, the Editor and Myles, the managing director at our interview with him. To be able to understand how people think and creatively phrase the question or explanation has been mastered by Mike through his 30+ years as an adviser and his 10 years studying investor behavioural psychology. As he felt the profession needed some simplicity, Mike decided to write his book called ‘Your Money and Your Life.’

The book is composed of two sections. Half is largely about life lessons, and it is important to note, this book is not only about money but also about life choices too. Chapters include Planning for the life you choose, the mistakes we make with our money and how to avoid them, wishes won’t bring riches, and how not to be a workplace prisoner. The other half of the book is focused on how to be a better investor by avoiding the mistakes the vast majority of investors make. Flowing through the whole book is an underlying theme of ‘Life is not a rehearsal’ which is something Mike believes very strongly in.

Mike has also designed a website to educate his clients and readers to keep them on the right track when it comes to their finances and mindset. The website, www.saverbehaviour.co.uk is like a Martin Lewis type website but exclusively around how to become a better investor. It is an educational tool, full of bite-sized information and easy to understand explainer video content to educate yourself around money and investing. Amongst some fantastic tools embedded into the website is a calculator which shows historically how much you would have amassed if you began investing just £1 a day in the stock market from the day you were born. We were both shocked when we did this for ourselves. We weren’t even close to guessing how much our investment would have grown too!

The book and the website are not just about money, they are about changing your perspective on things. Mike has done this in a way that is thought-provoking, creative and motivational, highlighting all of the common financial ‘blind spots’ that we make daily without being aware of them. However, reading is one thing, but doing is quite another. If you don’t push yourself, nobody will do it for you. This is where the psychological aspects come into play. Mike will run through scenarios that help you to see things from a different perspective and in turn, reveal a more capable version of yourself and how to be successful.

We can honestly say that we have never had a meeting quite like it before. Mike says the primary objective of any investment is to maintain its purchasing power so invest with prudence in mind, not performance. Anything above this should be deemed a welcome bonus. Investing wisely for your or for your children’s future can be done safely with the help and guidance of Mike. Your retirement funds should enable you to maintain your standard of living without fear of running out of money.

As far as planning is concerned, do you know how to accurately calculate how much money you are going to need for the rest of your life so you can live an independent and dignified retirement? In other words, do you know what your number is?

Mike teaches you how and explains this in detail in his book. He passionately believes that we should not retire from something, but to something. We need enough purpose in our lives to get up in the morning and enough money to be able to sleep at night.

Trusting the stock market with your money is something humans are not well-equipped to do. It can be daunting. Mike tells us ‘One of the biggest mistakes investors make is that they confuse volatility with permanent loss.’ These are two very different things. He then began to explain that the process of investing money into the stock market is comparable to a rollercoaster. As you strap yourself in, your mind is full of different emotions from fear to excitement and adrenalin and you experience the steep climbs and sharp drops and bends and loop the loops. This is volatility.

When upside down midway through a loop the loop, people are screaming ‘get me out of here!’, get me off this ride! – If you had managed to get out of your seat while upside down, that would be permanent loss. You don’t. You keep going until you come through the volatility and the ride reaches the end and you get out unscathed. Markets go up and down all the time, but long-term history has proven they go up much more than down over time. History has proven that the declines are temporary, but the advances are permanent. Explaining concepts like these to clients is key to managing their expectations.

Mike has only ever invested his clients’ money in things that have always worked. i.e., investing their money in a huge collection of thousands of the greatest business in the world. He will never invest their money in fads, flavours of the month, or things that just happen to be working now. This is not investing. This is speculating.

He prides himself on managing client expectations and being brutally honest with them. He makes it clear to his clients that their investments categorically will fall in value from time to time. Not might or could, they will. The important thing is to stick to the plan and to never be tempted to get off that ‘rollercoaster’ halfway through.

He recommends that clients take a ‘sloth-like approach’, to investing. Looking at the value every day will not help you in any way, just let time do its thing. This way you won’t be panicking about any temporary drops in the market and therefore won’t be tempted to withdraw it at the wrong time. Imagine if house prices were reported every day on the news. Thankfully, they aren’t so people don’t care to look.

Mike always works on a ‘no surprises’ policy by explaining everything important, very clearly so that the phone never rings with the dreaded, ‘You never said this could happen.’

Why Stock Markets Go Up Over the Long-Term and How the Patient Investors Benefit

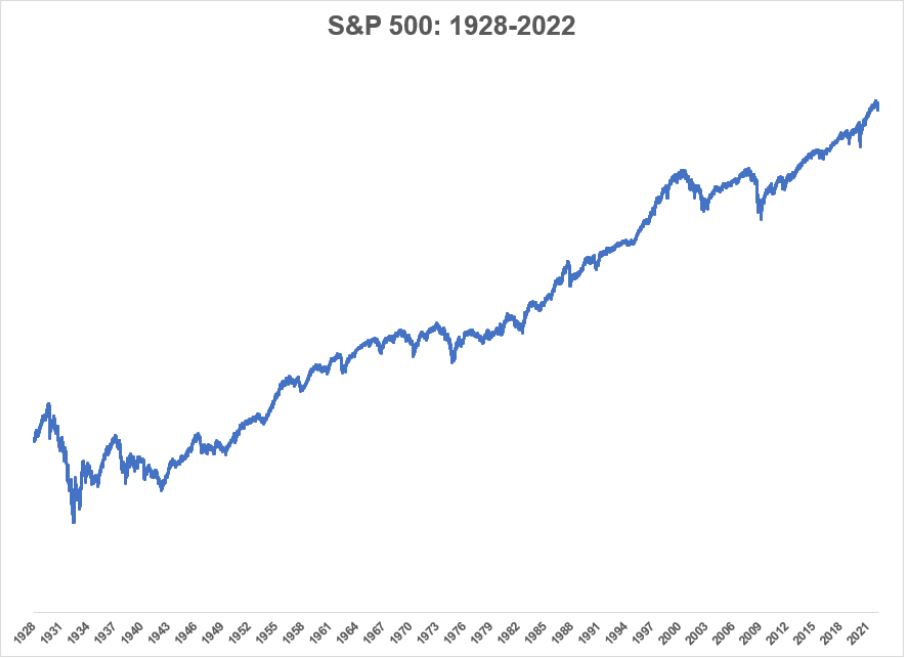

The long-term trend in the stock market has historically been up and to the right:

The S&P 500 is the 500 largest companies in America. Since 1928, the U.S. stock market (S&P 500 value) is up 9.8% per year. I use the S&P 500 as a benchmark barometer quite simply because it represents about 65% of the global economy whereas the UK stock market is only about 5%.

Historically the market is up roughly 3 out of every 4 years. There have been no 20-year periods where the U.S. stock market has been down on a nominal basis. I’ve gone over these kinds of stats ad nauseam over the years.

But why is this the case? Why does the stock market go up over the long-term?

I know a lot of people think the US Federal Reserve controls the stock market or low interest rates or it’s the Illuminati that’s pulling the strings.

In reality, the biggest reason the stock market goes up over time is because the economy grows, and corporations become more efficient and earn more money.

In 1928, earnings per share for the S&P 500 was $1.11 while corporations paid out $0.78 per share in dividends. It was impossible to do so at the time, but if you could have owned an index fund that tracks the collective performance of these companies, those would have been your per share cash flows at the time.

By the end of 2021, those numbers $197.87 and $60.40, respectively. This means over the past 94 years, earnings on the U.S. stock market have grown at an annual rate of 6% while dividends have grown 5% per year.

Being an investor in the stock market means you get to take part in the profits and cash flows of corporations. You get to benefit from their innovation, investment, and growth.

Let’s look at the biggest stock in the market as an example.

In its fiscal year ending 2014, Apple had sales totalling more than $182 billion with a net profit of $39.5 billion. In the fiscal year ending 2021, Apple’s revenue was $386 billion, and the company produced net profits of $94.7 billion.

Sales more than doubled while the company’s profit was up 140%. Meanwhile in that same time frame, Apple paid out more than $103 billion to shareholders in the form of dividends.

And Apple is not alone in paying out dividends to shareholders.

This number has gone down in recent decades with the rise in share buybacks, but the average pay-out ratio for S&P 500 corporations since 1928 is more than 50%. This means companies have paid out more than half of their profits to shareholders in the form of cold hard cash.

The market value of the entire U.S. stock market in 1982 was $1.2 trillion. Apple alone is now worth more than $2.5 trillion. The stock market goes up over time because businesses get bigger and more profitable and earn more money over time.

If you own stocks, you earn a piece of that company, that growth.

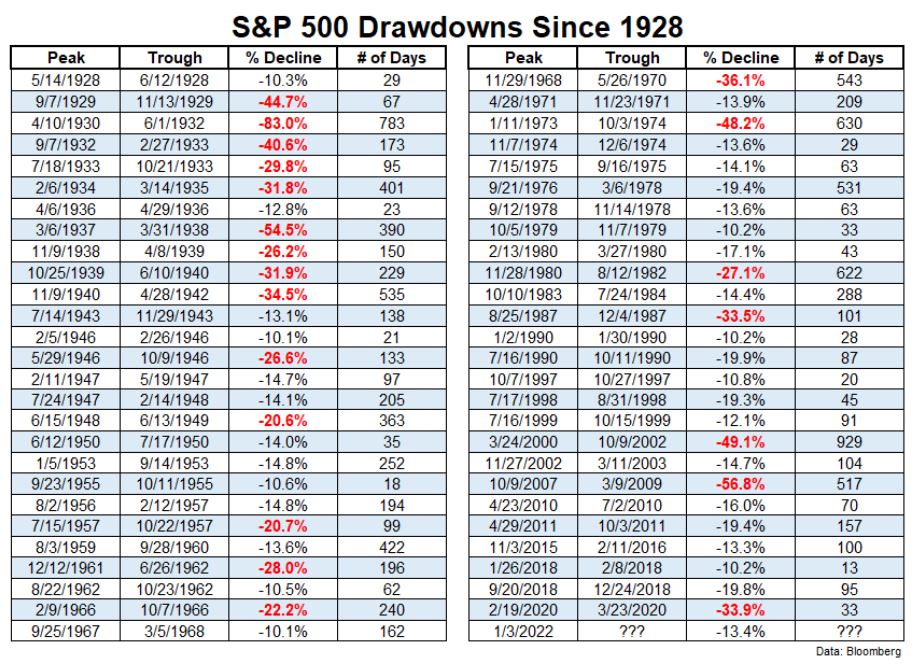

The stock market also goes up over the long-term because sometimes it goes down in the short-term.

And if you think about it — the stock market has to go down. It wouldn’t offer such juicy returns if you didn’t take a punch in the face every once and a while.

“Everyone has a plan until they get punched in the face” – Mike Tyson

Ten thousand dollars invested in the U.S. stock market in 1928 would have grown to something like $66 million today. That is the staggering effect of compound interest over time for the patient investor.

But look at all the carnage along the way to get to there:

The 4 most dangerous words in investing are: This Time It’s Different. It never is, it just feels this way sometimes.

When you invest in the stock market you don’t simply get 8-10% year in and year out.

No, you get some combination of huge gains followed by some temporary albeit painful losses. It has to be this way, or the long-run returns wouldn’t exist. Stock markets have always behaved this way.

If it was this easy surely everyone would become an investor?

If more people were properly educated to the way stock markets work, I am sure more would look to invest over the long term. The primary objective of money is to maintain its purchasing power. Providing your money is keeping pace or outstripping inflation over the long term, it means you never suffer a drop in your standard of living.

WHATEVER YOU DO, REMEMBER THIS:

We are not just invested up to retirement, we remain invested up to and THROUGHOUT retirement. For most people this is 60 to 70 (working life to death) years in total. How else do you think you will get a sustainable and rising income in retirement?

INFLATION – A DEADLY ODOURLESS KILLER OF WEALTH

To help me in my mission to educate you about inflation, I use the humble postage stamp to demonstrate the insidious effect inflation can and will have on the purchasing power of your cash over a typical three-decade retirement. It’s perfect, as everyone knows:

•What it does.

•What it looks like.

•It costs the same whether you’re buying it in Belgravia or Plymouth.

In short, it’s ubiquitous and so an effective way of demonstrating how an easily comprehensible, everyday item increases in price over time.

And lo, just recently, Royal Mail announced an inflation-busting increase to the price of stamps! The price of a First-Class stamp rose 10p to 95p on 4th April. That’s a rise of 12%.

Suffice to say (spoiler alert), the stamp has risen in price four-fold. Over any meaningful period of time, inflation is dangerous to your real wealth. At current levels, if it persists, it will utterly destroy people’s retirement lifestyles.

If “destroy” sounds dramatic, it’s because it is. People will only realise the truth – that risk has nothing to do with temporary volatility and everything to do with the destruction of purchasing power – when it’s too late. When they go to the bank to make another withdrawal from their “safe” cash stash, to be told it’s gone, exhausted, kaput. Because everything that once cost “y” now costs “y” x 4.

The fact that it’s not always easy is one of the biggest reasons the stock market goes up over the long-term. The great companies of the world that you and I use every day of our lives make profits far more often than not. We all buy their goods and services every day and we ultimately line their pockets and make them their profits over the years.

As investors we own a small part of thousands of these companies, but all companies and economies have tough times every now and again, but they will still be there making profits long after you and I are gone.

Managing our behaviour and reactions to all the media nonsense is the way to get these returns for the long-term view patient investor. It was, is, and always will be this way.

If your plan, timeframe, and goals have not changed then you should do absolutely nothing as this too shall pass. We have had many experienced investors wanting to invest more because they have seen this movie before and realise that markets are heavily discounted right now.

Bizarrely the stock market is the only ‘market’ in the world where everyone runs out of the store when everything is on sale! If your favourite food or drink was on sale or heavily discounted, you would probably fill your shopping trolley. You wouldn’t hold back and wait for the price to go back up; you would buy now, but sadly, this is what many investors do.

Director at Manning & Company, Behavioural Investment Coach, member of the Parliamentary Financial Review Team and the UK Leaders Council, 1st in the Southwest 2022 by Vouchedfor.com for achieving the most positive client reviews and not forgetting, great friend to his clients, Mike has gained a lot of knowledge, understanding, and trust throughout his career that he would now like to share with you,

the reader.

To buy his book, head to www.lulu.com or Amazon and other online book retailers. It comes in hardback, paperback, and Kindle versions with varying prices from £2.99-£29.95. He is also releasing an audiobook version very soon!