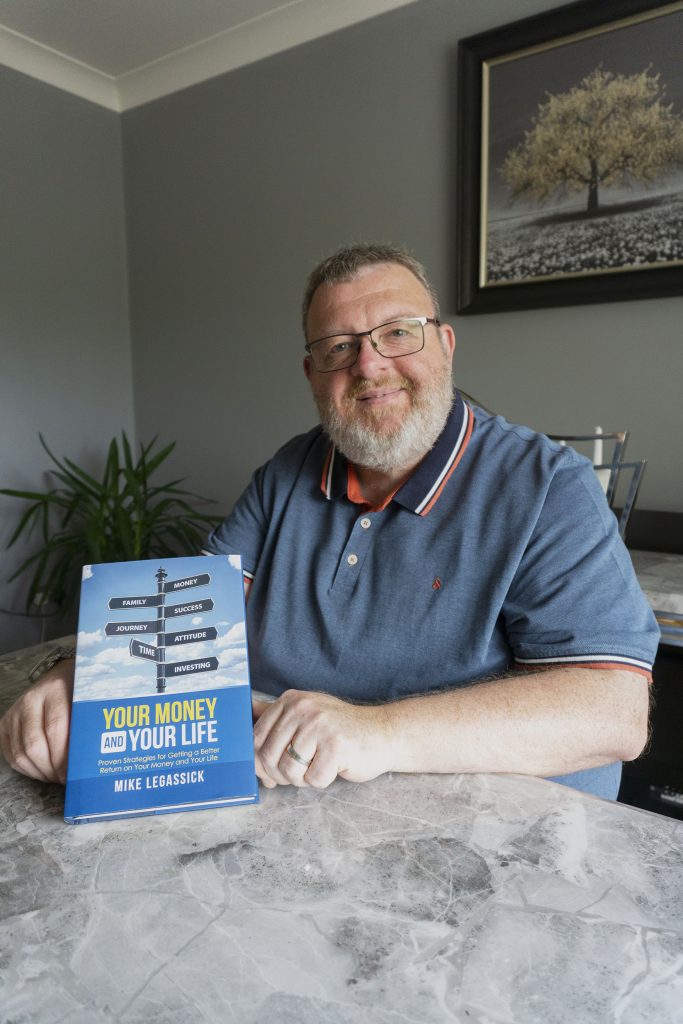

Your Personal Investment Coach: Mike LeGassick

INTERIOR DESIGN TRENDS FOR 2022

6th January 2022

Marjon Sport & Health

6th January 2022It’s that time of the year when we make resolutions to improve our lives in the new year. Health and finances always seem to be among the top areas we wish to improve. In this piece, I have decided to write about the 3 most important things that all investors need to be aware of.

Check out the magazine version: https://issuu.com/plymptonmagazine/docs/themagazine_om152_jan2022/34

One of the most common questions I get asked is “what’s working now Mike or where is the best place to invest now Mike?” My answer is always the same. I have only ever invested my clients’ money in what has always worked and that is a huge collection of the greatest companies on the planet. I have never invested my clients’ money in whatever the current fad happens to be. Examples of what people think are hot right now are Cryptocurrency, Brazilian Teak Farms, and Car Parks to name a few. If a client wants to invest in just one or two highly volatile, high-risk asset classes that’s up to them, but I will have no part of it. If it is money they can afford to lose completely and it won’t impact their financial and retirement plans then they can go and knock themselves out. After all, it is their money.

What’s Working Now? – The Turkey’s Story

To bring the permanent loss of capital or the ‘what’s working now’ dangers to life, try to think of them in terms of being a turkey on a farm. I know this sounds a little crazy, but please bear with me. You’re a turkey in a little coop and every day that goes by you become more confident and comfortable with the farmer and your environment. Why wouldn’t you? Every day he puts grain in one trough and water into another for you. This farmer clearly has your best interests at heart.

You have a nice warm place to live, and you are protected from natural predators. You really like and trust this farmer. You’re permanently hanging out with your family and friends, and you don’t have a care in the world. Life is good. You’re getting really well fed and every day you are getting bigger, bigger, and bigger.

So as time passes you grow more comfortable and settled in your rosy idyllic surroundings – that is, until a few days before Christmas when things take an unexpected turn for the worse. You get an unsettled feeling that something is not right. The farmer has not come in as usual, he’s late, and then suddenly the shed door is flung wide open and there’s a big truck outside and all your friends and family are getting loaded into the truck. Christmas is just a few days away. You’re thinking to yourself “what’s going on here?” You don’t know it yet, but you are soon going to be someone’s Christmas lunch.

And it was all going so well until that day. This is what the permanent, irretrievable, loss of capital feels like. Similarly investing your life savings in something that just happens to be working right now, the latest fad, most often produces the same outcome. Just when you thought that things could not get any better, reality bites and BANG! GAME OVER.

Do your investments have the characteristics of the turkey, that misplaced trust, the false sense of security? If so, ask yourself whether you could be the turkey here?

The Rollercoaster

In over 30 years as an investment adviser, the single biggest and most dangerous mistake I have seen people make is confusing volatility with the permanent loss of capital. Be very aware that these are 2 very different things.

You should think about volatility as being on a rollercoaster. If you have ever been on a rollercoaster, you probably experienced mixed emotions as you were about to get into your seat. Most people feel excited and fearful. You know that this is going to be both scary and exhilarating. You sit down, you lock the safety bar into place across your chest thinking that this is a bit tight, and you start your steep, high climb up the rollercoaster track.

Up you go higher and higher to the apex and then as you drop down the other side at high speed you are screaming thinking you’re about to die. You go through the first loop the loop and then the second loop the loop and all you are thinking is I want to get off this, I want to get off this, please let me get off this! I’m going to die! You go through the final loop the loop and then the rollercoaster slows down to a gentle stop, and you get out safe and sound.

You know that had you attempted to get yourself out mid-ride in the middle of one of those loops there would have been very serious consequences, a high chance of permanent loss, but you didn’t, you sat tight and finished the ride. Think of volatility as the ups and downs and unpredictability of prices over a rising trend line over time. Think about volatility as a rollercoaster ride. Investing is a little like walking upstairs using a yoyo. The ups and downs are inevitable but the journey on the stairs is upward.

Inflation – The Relentless, Silent Assassin

Inflation ensures the slow, pervasive, erosion of the purchasing power of your money. Put simply, all your cash and invested assets really are, is the future purchasing power of your money. This is what all money and currency is, and inflation is a relentless and very dangerous flavour of risk. I refer to inflation as the silent assassin. The story below brings this vividly to life.

The Swan Ice Sculpture

The story to bring inflation to life is the beautiful swan ice sculpture often seen at weddings. You arrive in the morning in all your finery. All your friends are there, and you are looking forward to a great day. And there it is, a beautiful swan ice sculpture that is the centrepiece of where you are having your canapés and drinks. It looks stunning and everyone is admiring it and commenting on it. It is pristine. You can clearly see the detailed definition of the feathers and the beak and there is a drip tray underneath it and there is not a single drop of water in the drip tray, and you think, wow, that is impressive.

And then you get on with the wedding proceedings, you have the ceremony and you come back for some light snacks and refreshments, and you look at the swan and the drip tray and you think wow, there’s a lot of water in there now. You look at the swan and, and think, well, it’s sort of a swan. You can just about make out that it is a swan. You come back much later after the buffet and you’re wondering what has happened to the swan ice sculpture. What once stood majestically is now unrecognisable. It just looks like an undefined melting block of ice and the drip tray is now completely full of water.

To bring inflation to life, think of it as a swan ice sculpture at a wedding, the slow, continual, drip, drip, drip of you relentlessly losing your money’s purchasing power to inflation. The primary requirement for any money you might have saved or invested is for it to maintain your purchasing power and standard of living. Providing your money, wherever it is held is growing at least by the rate of the increasing cost of living you will never suffer a drop in the standard of living. Unfortunately, as I write this, interest rates on savings remain at historic lows.

Most people are struggling to get 0.5% on any savings. Inflation is currently 4.2%. This means that any money you have saved at say 0.5% is losing 3.7% per annum to inflation. So let’s look at a monetary example of this. In 10 years’ time, £50,000 held on deposit will still show £50,000 in your account but will only be worth £34,768 in real terms. Yes, you read that right. Your £50,000 in just 10 years has lost an annually compounded 3.7% and will now only be able to buy goods and services to the value of £34,768 because of that silent assassin inflation. Ouch! Using long-term inflation trends, the cost of living increases about 2.5 times over a 30-year retirement. A first-class stamp in 1991 was 24p. A first-class stamp today is 85p. That is a whopping increase of 254% over a 30-year period!

If you want to find out more on how to be a smarter investor, how to get your savings to grow at the same rate as inflation or more, and how much you need to retire comfortably and stay comfortably retired, please contact me on 01752 837950 or visit my client education and behavioural investor website which brings all of the above to life: www.saverbehaviour.co.uk

Mike specialises in investing, inheritance tax planning, and retirement planning. Mike is also a member of the Parliamentary Review and has written a piece for them which was sent out to over 500,000 businesses in the UK.)